Routt County /Steamboat Springs Real Estate Market Update for Novemeber 2011

Thursday, December 22, 2011

November was a great month for the [tag]Steamboat Springs real estate[/tag] market, up quite a bit over last year’s November. (90%) Gross volume in November came in at $51,948,300, and had a total of 125 Transactions. This big shot in the arm leaves your YTD, Gross volume slightly off last YTD, but under -10%. Transaction wise, November was strong with 125 transactions, although general transaction numbers are still down.

There was strong [tag]residential[/tag] activity in November. 66 of the transactions were for Improved Residential properties (up from 47 last month). In an addition, all of the Residential trend-point totals are showing up green. The upper end residential market was very favorable in November, as you’ll see in the Price Point summary and by the highlighted sales below.

[tag]Bank sales[/tag] are also up this month with a total of 15.

Sales over $1.5M:

11/29/2011 $2,475,000 [tag]Robbins[/tag] Subdivision Lot 117 aka 0674 Steamboat Boulevard – 5 Bedroom 6 Bath YOC 2007 with 7,305 SF Living Area on .60 AC Land. PPSF is $338.81.

11/7/2011 $1,850,000 Eagle Glen #1 Replat Lot 1, [tag]Eagleridge[/tag] Lot 1, Block 4 aka 1451 Eagle Glen Drive – 4 Bedroom 5 Bath YOC 2004 with 4,741 SF Living Area on .31 AC Land. PPSF is $390.21

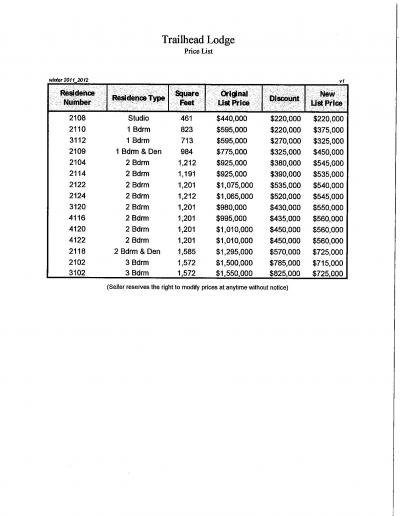

Trailhead Lodge releases winter 2011-2012 price list with huge reductions in the Steamboat Springs real estate market

Saturday, November 19, 2011

See more details about Wildhorse

See more details about Wildhorse See more details about Trailhead at Wildhorse

See more details about Trailhead at Wildhorse [tag]Trailhead Lodge[/tag] releases winter 2011-2012 price list with huge reductions in the [tag]Steamboat Springs real estate[/tag] market. Some of these units have discounts greater than 50%! The snow is flying here at the [tag]Steamboat Ski Area[/tag] and opening is a few days away, so now is the time to snap up the current bargains. Contact me for more information.

[tag]Trailhead Lodge[/tag] releases winter 2011-2012 price list with huge reductions in the [tag]Steamboat Springs real estate[/tag] market. Some of these units have discounts greater than 50%! The snow is flying here at the [tag]Steamboat Ski Area[/tag] and opening is a few days away, so now is the time to snap up the current bargains. Contact me for more information.

See more details about Wildhorse

See more details about Wildhorse See more details about Trailhead at Wildhorse

See more details about Trailhead at WildhorseFreddie Mac Launches Winter REO Sale which includes the Steamboat Springs real estate market

Thursday, November 17, 2011

HomeSteps, a [tag]Freddie Mac[/tag] real estate sales unit, kicked off a sales promotion this week to unload some of its inventory of [tag]foreclosed[/tag] homes in several cities which includes the [tag]Steamboat Springs real estate[/tag] market

Its Winter Sales Promotion for owner-occupant buyers includes:

- Paying up to 3 percent of the final sales price toward the buyer’s closing costs for initial offers received between Nov. 15 and Jan. 31, 2012. Escrow must be closed on or before March 15, 2012, to qualify.

- Two-year Home Protect limited home warranty, which covers such things as the heating, air conditioning, electrical, plumbing, and other major systems and appliances. Home Protect also will offer a discount of up to 30 percent on the purchase of appliances. (For eligibility requirements, visit www.HomeSteps.com/smartbuy.)

For more information on the HomeSteps Winter Sales Promotion, visit www.HomeSteps.com or contact me.

October Routt County Statistics for Steamboat Springs Real Estate

Thursday, November 10, 2011

October is a mixed bag for the [tag]Steamboat Springs real estate[/tag] market: down slightly from last month in volume, and down even more in transactions - however, all of the difference is in Interval closings, which were significantly lower than last month.

The residential market had a consistent and strong showing with close to the same numbers as last month, and a predominance of residential trend points that were trending higher. Also, you’ll find several upper end residential closings which are noted below.

[tag]Bank sales[/tag] were down tremendously, with only 6 in October as opposed to 18 in September..

Highest Priced Sale for October 2011:

10/27/2011 $3,375,000 [tag]Agate Creek[/tag] Preserve Subdivision Lot 1 aka 35375 Humble Road – 5 Bedroom 5.5 Bath YOC 2004 with 8,137 SF Living Area. 7.57 AC Land Area. Price per square foot (PPSF) $414.77.

Highest PPSF for October 2011:

10/6/2011 $2,030,000 One Steambaot Place Condo @ Après Ski Way Condo Unit R-418 aka 2250 Après Ski Way – 4 Bedroom 4 Bath with 2,420 SF Living Area. PPSF is $838.84. This is a new construction sale that is located in the Steamboat Mountain Area.

Other sales over $1.5M:

10/12/2011 $2,155,000 [tag]Werner Ranch[/tag] Subdivision #3 Lot 2 – aka 34225 State Highway 131 – 4 Bedroom 5 Bath YOC 2008 with 4,199 SF Living Area on 35.020 Acres of Land. PPSF is $513.22. This sale is located in the South Routt Area.

10/31/2011 $1,500,000 [tag]One Steamboat Place[/tag] Condo @ Après Ski Way Condo Unit R-103 aka 2250 Après Ski Way – 4 Bedroom 4 Bath YOC 2009 with 2,384 SF Living Area. PPSF is $629.19. This is a new construction sale that is located in the [tag]Steamboat Mountain[/tag] Area.

Contact me for more information.

VA loans make a comeback in the Steamboat Springs real estate market

Thursday, October 20, 2011

Some [tag]mortgage[/tag] lenders and brokers in the [tag]Steamboat Springs real estate[/tag] market are seeing a resurgence of [tag]VA loans[/tag] Here are a few helpful tips: VA provides up to 100% financing on the purchase of a primary residence There is no monthly mortgage insurance! There is an upfront funding fee that varies from 1.25% to 3% depending on service, down payment and prior use of the VA product. This fee can be financed into the loan. A 41% debt ratio is required A certificate of eligibility or form DD214 is helpful for the borrower to bring in when they come in to get pre-qualified.

Steamboat Springs real estate price cut at Wildhorse First Tracks

See more details about Wildhorse

See more details about WildhorseJust released in the [tag]Steamboat Springs real estate[/tag] market, prices are significantly reduced to close-out Phase I at [tag]First Tracks[/tag] at [tag]Wildhorse[/tag]. After 35 successful sales in the past two years, only 12 residences remain. Now’s the perfect time to purchase at First Tracks with great financing options and some of the best residences still available. Studios now from to $99,000 1 bedrooms reduced to $169,000 (*only one remains) 2 bedrooms now from $229,000 ($70k reduction) Contact me for more information today

See more details about Wildhorse

See more details about WildhorseCondo buying season in Steamboat Springs is here! Ski-in convenience with walk-to-ski value; rent your real estate to defray costs

Friday, October 14, 2011

See more details about Lodge

See more details about Lodge See more details about Phoenix

See more details about Phoenix See more details about West

See more details about West See more details about Trappeurs Crossing

See more details about Trappeurs CrossingI often am asked which condos rent the best in the [tag]Steamboat Springs real estate[/tag] market. This is usually answered simply and overwhelmingly with [tag]ski-in ski-out[/tag]. However, rental income for a [tag]ski-in[/tag] [tag]condo[/tag] will vary depending on the condition of the residence. A newer or recently renovated condo within walking distance to Steamboat skiing will cost much less and see higher rental revenues than a fixer-upper ski-in condo. I’ve had a couple of owners of [tag]slope-side[/tag] condos recently state they barely covered their home owner association (HOA) and resort management fees last two seasons. This is due in part to the slow economy and increased inventory from a building boom in 2007, but is also due to the price point and the condo rating. Price conscious travelers in many instances are opting for a [tag]Trappeurs[/tag] condo, such as [tag]Emerald[/tag] or [tag]Bear Lodge[/tag], because they can get higher quality and another bedroom for the same price. Bear Lodge is about 2 blocks East of [tag]Gondola Square[/tag]. At times, a 3 bedroom will rival the rental price of a 2 bed ski-in. Patio units with private hot tubs are popular as well. The quality finishes and convenient amenities like pools, hot tubs and fitness rooms add value. Many travelers will choose to walk a block to skiing for a 4 star or A-rated experience. A trend we are seeing near the slopes is older buildings taking on a new look. The [tag]West[/tag] and The [tag]Phoenix[/tag], both within walking distance to the slopes, have beautiful new exteriors. The assessments were steep, but the payoff of the HOA special assessment (if not paid by seller already) can always be negotiated in a contract to purchase. For example, many condominiums at the West could use kitchen upgrades to boost rental demand; regardless, a studio condo netted an income after HOA fees, management fees and taxes. Depending on your personal use, its typical to see rental incomes offset those carrying costs before your debt service. Prices are around 20 to 40% off our high sales in 2007. Several condominium developments within walking distance to Steamboat’s Gondola Square and ski slopes are worth investigating before the winter sales season because they may be new, newly renovated or show consistent rental revenue from good management and marketing. Under $500,000 look to are The West, Phoenix and [tag]The Lodge at Steamboat[/tag]. Over $500,000 but under $1,000,000, and for more bedrooms, look to Emerald or Bear Lodge at Trappeurs. If you don’t mind a short walk to the slopes and rental income is important to you, look past the slopes and you will certainly find more bang for your buck without sacrificing convenience. Contact me for more information today.

See more details about Lodge

See more details about Lodge See more details about Phoenix

See more details about Phoenix See more details about West

See more details about West See more details about Trappeurs Crossing

See more details about Trappeurs CrossingPieces Fall Together in the Steamboat Springs Real Estate Market; Seller Financing Option using a Wrap.

Sunday, October 9, 2011

[tag]Colorado Group Realty[/tag] brokers worked together to complete a “remarkable” and “extraordinary” deal involving multiple properties, owners and buyers at the end of September in the [tag]Steamboat real estate[/tag] market. With one deal dependent on the other, four homes involving five homeowners were bought and sold in a three-day period at the end of September! It’s especially noteworthy given today’s real estate market and lending climate. From Steamboat Today

From price negotiations, home inspections, appraisals and financing, everything had to happen smoothly for the deals to close.

However, offers relying on a contingencies being met don’t always work out as smoothly as in the above transactions. As an example, an owner has an offer [tag]contingent[/tag] on the buyer selling and closing their home in order to purchase, but it doesn’t work out as planned and the buyer doesn’t see an offer by the contingency deadline - is there another option? If the home buyer has some equity in their home and an acceptable down payment to cover the seller’s closing costs, the seller could consider owner-financing the real estate purchase without paying off their existing mortgage using what is called a [tag]wrap-around mortgage[/tag], or “[tag]wrap[/tag]” for short. When the home buyer eventually sells, they pay the seller, effectively allowing a much longer time for the buyer to sell their home. The seller takes enough down to cover closing costs and cover any risk of the buyer walking while the buyer makes payments to the seller who in-turn pays the existing mortgage. Of course, terms all have to make sense to both parties. Also, there are legal matters to consider, summarized in this article. For example,

if the seller owes on an [tag]FHA[/tag]-insured (post March 1, 1988) or a [tag]VA[/tag]-insured (post December 15, 1989) note and deed of trust, wrapping either of those types of [tag]loans[/tag] is considered improper - possibly even fraudulent - by [tag]HUD[/tag], and is not recommended.

Since I’m not a real estate lawyer, please see the above article for more ideas about this type of transaction. I’ll help you find the home and Oliver can help us with the details of the “wrap”. Call me or contact me for a list of homes where the seller is willing to finance or trade. Colorado Group Realty, Broker/Owner 970-846-8284